When government regulation is removed, history becomes a poor indicator of the future. Disruption is predictable when increased competition, choice and transparency drive new market entrants and revenue models. Assumed loyalty is dangerous when comparative analysis is as close as a mobile phone.

An historical service mindset of ‘appreciate what you get because you have no choice’ conflicts with consumer’s growing ability to choose ‘what best meets my needs’ in a deregulated market.

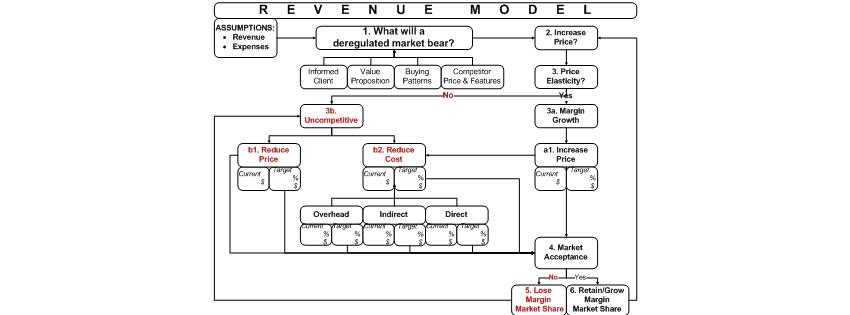

Happiness is a positive cashflow. A revenue model makes financial sustainability possible by:

- revising and restating assumptions to make the invisible visible

- defining ‘value’ as redefined by clients

- putting a price on ‘value’ and

- identifying who is prepared to pay a premium for value

- targeting the most profitable revenue streams

A failed revenue model is no cause for celebration when unstated revenue and expense assumptions are exposed in the harsh realities of a deregulated market. Remaining competitive in times of disruption requires collaborative thinking to apply constraints management, lean six sigma and process excellence along the value stream.

Strategists read the wind by understanding their value proposition, client expectations, buying patterns and competitors to identify the price, features and service that changing markets will bear.

A target price objective meets the market to deliver client’s value expectations and a target margin based on costs under various volumes. Target costing utilises business intelligence to deliver client value and a sustainable business. The objective is to set and achieve a price that delivers a target margin (offense strategy) or target cost (defence strategy).

In regulated markets, overhead is often hidden and can grow out of proportion. In a deregulated market, corporate overhead is transparent and should be examined with rigour and vigour to identify real value to the client.

Removing constraints and improving throughput by streamlining indirect and direct costs adds value to the extent it is perceived by the client as value, improves throughput and/or reduces cost.

Accounting measures quantitative factors in target costing. Stakeholders reflect the ‘voice of the customer’ on qualitative factors such as features, benefits, demand and logistics. Strategy, people, process and productivity determine revenue, margin, cost, flow and throughput.

Understand price elasticity or suffer fatal consequences. Price and cost decisions which fail to meet the market definition of value can lead to lost revenue, lost margin or lost market share. Reducing price to prop up an unsustainable business model has a predictable outcome.

Conversely, price based on informed target costing can deliver increased margin and/or increased market share.

Use the flow chart above to assess your revenue model. If you are want support in strengthening your revenue model or a copy of the revenue process map, contact ceo@bluechipconsultinggroup.com.au or ring John Cleary on 0411 522 521.